In today’s fast paced financial world staying updated with real time data is essential. Fintechzoom.com European Indices Today brings you a comprehensive overview of how key equity indices across Europe are performing.

From the DAX in Germany to the FTSE 100 in the UK these indices reflect investor sentiment economic health and emerging trends across the continent.

In this article we’ll explore index performance analyze market fluctuations assess trading volume, and provide insights into investor strategies.

Overview of European Indices Today

European indices serve as vital barometers for measuring the overall economic activity and investor confidence in the region.

As of today, many indices have responded to geopolitical developments, central bank announcements and commodity price fluctuations.

According to Fintechzoom.com European Indices Today movements in benchmark indices have been more reactive to macroeconomic indicators than usual.

Major Indices in Focus

Each European country has its own flagship index. Today’s movement in these indices provides insights into regional economic strength.

- FTSE 100 (UK): Known for its international exposure and stability.

- DAX (Germany): A key benchmark for the Eurozone’s largest economy.

- CAC 40 (France): Focused on domestic and European companies.

- IBEX 35 (Spain): A reflection of the Spanish economy and banking sector.

Market Performance Highlights

Most indices showed modest declines due to rising oil prices and interest rate concerns. However, specific sectors such as energy and technology remained resilient.

- Volatility rose as investors reacted to inflation data.

- Financial and travel sectors lagged behind.

- Defensive stocks like utilities gained modest traction.

Daily Trends Summary

Traders observed a mixed pattern today. While early trading hours saw slight optimism, mid-day sell-offs led to a more cautious tone in the market. Investor sentiment was also influenced by external news, particularly from the U.S. and Asia.

Reports featured in Fintechzoom.com European Indices Today have highlighted that this uncertainty is likely to persist.

Economic Indicators Affecting the Market

Market movements are rarely random. They respond to changes in key economic indicators that shape monetary policy consumer behavior and investment strategies.

Inflation and Interest Rates

With inflation numbers climbing, central banks like the European Central Bank (ECB) are considering further tightening. Investors worry that increased borrowing costs will dampen business activity.

- ECB rate hike speculation has caused bond yields to rise.

- Financial stocks are under pressure due to tighter lending margins.

Oil Prices and Energy Markets

Energy remains a double-edged sword. While oil companies benefit from high prices, sectors like travel, retail, and manufacturing struggle.

- Brent crude prices hovered above $75/barrel.

- Transportation companies saw significant sell-offs.

Currency Exchange Volatility

Currency strength plays a major role in trade and export competitiveness. Today the euro weakened slightly against the dollar pressuring exporters and increasing costs for imports.

Insights from Fintechzoom.com European Indices Today suggest that currency fluctuations may continue to shape investor strategy in the short term.

Sector Specific Performance

Understanding how different sectors are reacting to economic news is crucial for crafting sound investment strategies.

Financial Sector

Banks and insurance firms faced a tough session amid rate uncertainty and sluggish loan demand.

- Bank stocks declined up to 2% in major indices.

- Investors remain cautious ahead of ECB decisions.

Technology and Innovation

Despite a soft global outlook, some European tech stocks held their ground thanks to strong earnings reports and robust digital growth.

- Fintech platforms gained mild traction.

- AI and analytics -driven companies remained stable.

Industrial and Manufacturing

Automakers and industrial equipment manufacturers saw mixed performance, often impacted by trade-related headlines and raw material costs.

- Tariff concerns weighed on German automakers.

- Aerospace firms benefited from increased airline demand.

Trading Volume and Market Fluctuations

Volume and volatility offer clues into market conviction and trading behavior.

Increased Trading Volume

Today saw a higher-than-average trading volume, particularly in defensive and commodity-based sectors.

- High volume often signals institutional investor activity.

- ETFs tracking European indices saw notable inflows.

Short Term Volatility

Intraday fluctuations were significant due to conflicting signals from macroeconomic data and central bank commentary.

- Day traders capitalized on short swings.

- Long-term investors stayed defensive.

Investment Opportunities and Portfolio Strategies

In uncertain markets, strategy is more important than speed. Wise investors adapt their portfolios based on risk assessment and market trends. A recent report in Fintechzoom.com European Indices Today advised caution while seeking new opportunities.

Defensive Investing

With rising interest rates and geopolitical tension, defensive strategies gained popularity.

- Focus on dividend paying stocks.

- Emphasis on utilities, healthcare, and consumer staples.

Diversified Portfolios

Diversification remains a cornerstone of risk management. Blending sectors and regions helps cushion against volatility.

- Multi-asset funds saw steady inflows.

- European indices tracking funds gained modest interest.

Long Term Growth Potential

Despite short term uncertainty, analysts remain optimistic about long term prospects in Europe’s green tech, fintech, and industrial innovation sectors.

- ESG-focused funds are growing.

- Sustainable energy and automation firms offer upside.

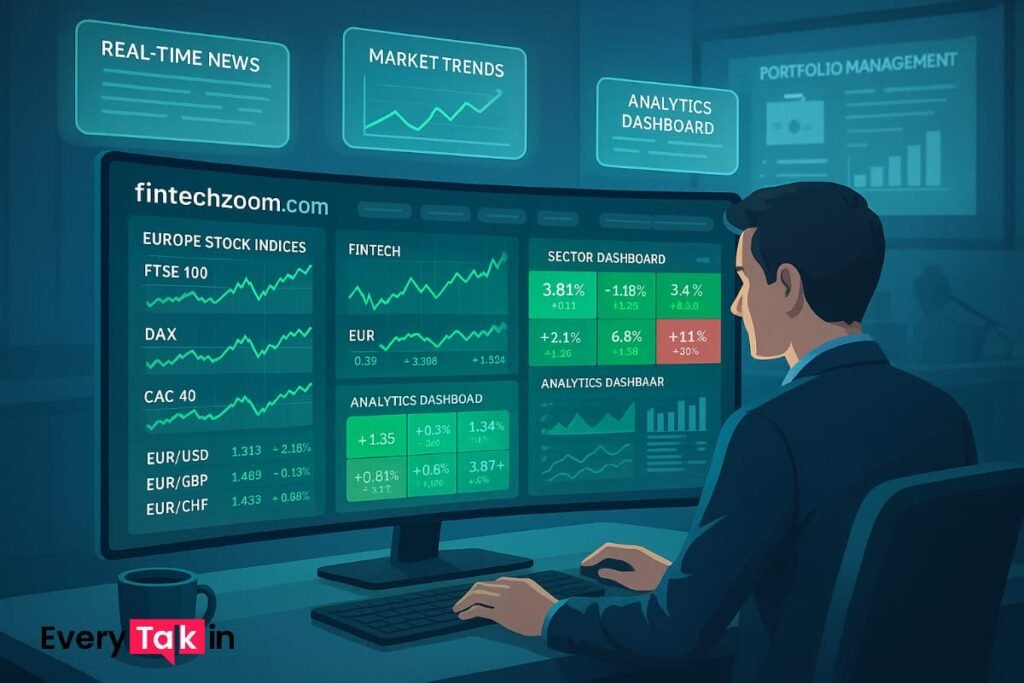

The Role of Fintechzoom in Market Updates

Fintechzoom has become a reliable source for financial data, market trends, and real-time analytics across the European financial markets.

Real Time Financial News

Investors rely on Fintechzoom for up to the minute updates on index performance, sector shifts, and global financial events.

- Alerts on breaking economic developments.

- Consistent coverage of benchmark indices.

Analytics and Data Insights

Through dashboards and market summaries, Fintechzoom provides powerful tools for tracking indices, monitoring trading platforms, and analyzing investor sentiment.

- Customized dashboards for different sectors.

- Real-time stock tracking and currency exchange updates.

Educational Resources

Fintechzoom also offers learning tools for those new to market analysis, including articles on financial technology, index tracking, and portfolio management.

- Beginner-friendly guides.

- Expert commentary and trend reports.

If you want to understand Europe’s stock landscape, turning to Fintechzoom.com European Indices Today is one of the smartest steps you can take

Conclusion

Fintechzoom.com European Indices Today is more than just a market snapshot; it’s a gateway to understanding the underlying currents shaping Europe’s economic and investment landscape.

From inflation data to trading platforms, today’s index performance reflects a balance of caution and opportunity. Whether you’re a first time investor or a seasoned professional, staying informed is key.

By leveraging trusted platforms like Fintechzoom and analyzing trends across sectors you can make smarter more strategic financial decisions in a fluctuating market. Bookmark Fintechzoom.com European Indices Today to stay ahead of daily developments.

FAQs

What is Fintechzoom.com European Indices Today?

It refers to the latest performance updates and market insights of key European stock indices provided by Fintechzoom.

Which European indices are most tracked?

The FTSE 100, DAX, CAC 40, and Euro STOXX 50 are among the most followed benchmarks in Europe.

How does inflation affect European indices?

Rising inflation typically leads to interest rate hikes, which can negatively impact stock prices, especially in rate-sensitive sectors.

Why do oil prices impact the stock market?

Higher oil prices raise costs for businesses and reduce consumer spending, which can drag down overall market performance.

Is Fintechzoom reliable for market updates?

Yes, Fintechzoom is a trusted source offering real time market data, expert analysis, and financial insights on global and European markets.