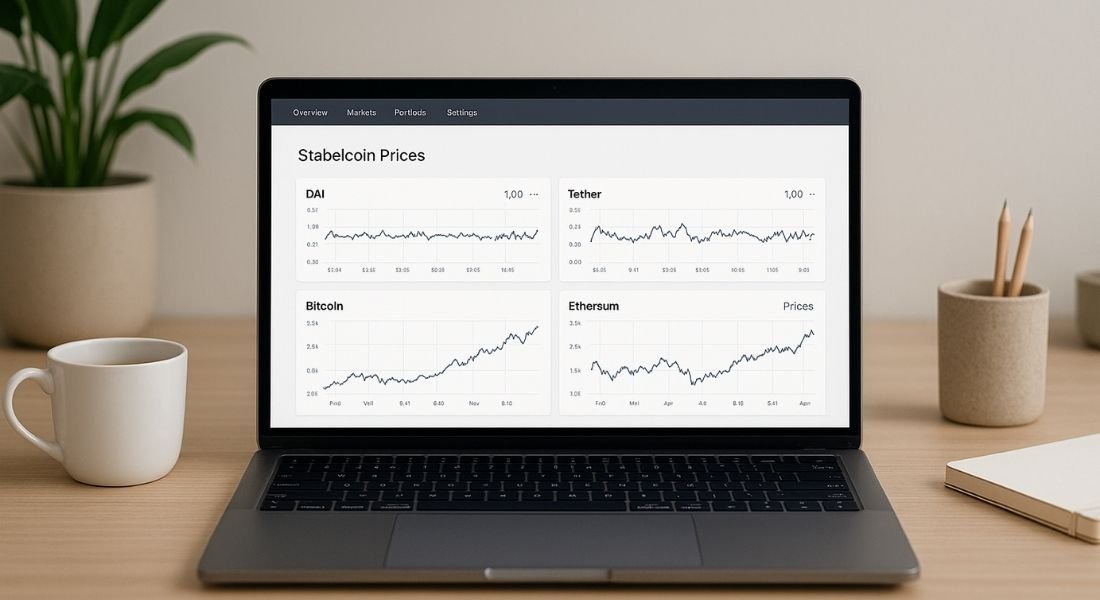

In today’s ever changing cryptocurrency world, Biitland.com stablecoins have emerged as a reliable solution for traders, investors and everyday users seeking a secure digital currency with price predictability.

Unlike the volatility associated with Bitcoin and many altcoins, stablecoins aim to maintain a steady value, making them crucial in the broader blockchain and decentralized finance (DeFi) landscape.

This guide unpacks what makes Biitland’s stablecoins unique, how they work, why they matter and how you can use them effectively in your crypto portfolio or digital transactions.

What Are Biitland.com Stablecoins?

Biitland.com stablecoins are digital assets designed to maintain a fixed value, usually pegged to a fiat currency like the US dollar. This means 1 unit of a Biitland stablecoin typically equals $1, backed by either collateralized reserves (e.g., USD, USDC or Tether) or algorithmic protocols that automatically stabilize the price.

They run on top of blockchain technology and are governed by smart contracts, ensuring transparency, traceability and trustlessness (no middlemen). These stablecoins play a vital role in token swaps, trading pairs and as a hedge against market volatility.

Biitland’s approach blends the strength of asset backed reserves with cutting edge algorithmic mechanisms, allowing for rapid transactions, low transaction fees and reliable value preservation.

Why Stablecoins Matter in the Crypto Space

They provide a crucial bridge between volatile cryptocurrencies and traditional fiat currencies, enabling more predictable and secure financial transactions.

Price Stability for Day to Day Use

While assets like Ethereum and Bitcoin fluctuate in value daily, stablecoins provide consistency, making them ideal for cross border payments, remittances and peer to peer transactions. They are also used as a reserve currency for digital economies.

A Key to DeFi Ecosystems

Biitland.com stablecoins are integral to DeFi platforms. They fuel staking, yield farming and liquidity pools tools that generate passive income. In volatile markets, stablecoins serve as a risk management anchor.

Global Financial Inclusion

With only a smartphone and internet, users in underbanked regions can access financial services such as saving, sending money and investing without needing a traditional bank.

Improved User Experience

Biitland focuses heavily on user engagement and interface simplicity. Whether you are trading on a crypto exchange, investing in NFTs or building a crypto portfolio, stablecoins offer a seamless, intuitive experience.

How Biitland.com Stablecoins Work

Biitland.com stablecoins function by maintaining a 1:1 peg with fiat currencies through asset backed or algorithmic mechanisms, ensuring price stability and seamless integration into decentralized finance applications.

Pegging Mechanism

Biitland’s stablecoins are pegged to the US dollar through a combination of fiat reserves and algorithmic models. This hybrid model blends the collateralization of coins like USDC or Tether with the smart contract based elasticity of DAI or other algorithmic stablecoins.

Blockchain Infrastructure

Running on Ethereum compatible blockchains, Biitland stablecoins benefit from interoperability, high security and fast confirmation times. They integrate well with decentralized applications (dApps), wallets and decentralized exchanges (DEXs).

Proof of Stake & Network Effects

The platform uses proof of stake (PoS) consensus mechanisms, enhancing scalability, reducing energy use and strengthening market infrastructure. Over time, network effects improve token utility and trust.

Key Benefits of Using Biitland Stablecoins

Biitland stablecoins offer users faster transactions, reduced volatility and seamless access to decentralized finance tools, making them ideal for everyday crypto use and long term value preservation.

Stability in Volatile Markets

Traders can lock in profits by converting gains into stablecoins, minimizing exposure during high market volatility or bearish runs.

DeFi Participation

Biitland.com stablecoins are compatible with top DeFi protocols, enabling you to stake, lend or provide liquidity with predictable returns.

Fast, Low Fee Transactions

Because they are built on scalable blockchain layers, you can send stablecoins almost instantly for minimal cost that is ideal for remittances or international business.

Security and Trust

Smart contracts ensure that reserves and price control mechanisms operate transparently. Regular audits, regulatory compliance and digital identity integrations increase investor confidence.

Support for NFT & Token Economy

Biitland stablecoins can be used in NFT marketplaces or paired with security tokens for more complex tokenomics and asset diversification.

How to Get Started: A Practical Guide

Here’s how to start using Biitland.com stablecoins in a few simple steps:

Step 1: Set Up a Compatible Wallet

Download a crypto wallet (like MetaMask or Trust Wallet) that supports Ethereum or Biitland’s native blockchain.

Step 2: Create a Biitland.com Account

Register, complete KYC/AML verification and access the crypto exchange dashboard.

Step 3: Fund Your Wallet

Deposit Bitcoin (BTC), Ethereum (ETH) or fiat through supported payment methods.

Step 4: Swap for Stablecoins

Use the exchange’s token swap interface to convert your crypto to stablecoins. Monitor trading volume, price spreads and trading pairs for the best rates.

Step 5: Use or Invest

Send stablecoins to others, deposit them into liquidity mining protocols or stake for governance tokens and rewards.

Real World Use Cases

Biitland stablecoins are used for cross border payments, DeFi staking, remittances and everyday transactions, offering a reliable medium of exchange that bridges traditional finance and blockchain ecosystems.

E-Commerce Payments

Merchants can accept Biitland stablecoins to avoid the delays and fees of credit card processing, offering a faster, cheaper, borderless payment option.

Payroll in Crypto

Freelancers and remote workers can get paid in stablecoins, which retain value and convert easily into local currencies.

Inflation Hedge

In countries facing high inflation, stablecoins act as a store of value, offering more reliability than the local currency.

Institutional Trading

Institutional investors use stablecoins for high volume trading, market making and efficient fund transfers between exchanges.

The Evolution of Biitland Stablecoins

Biitland stablecoins are set to expand their ecosystem with multichain support, increased regulatory compliance and advanced tokenomics empowering users globally with greater financial sovereignty, scalability and seamless integration across decentralized applications.

Blockchain Innovation

As blockchain scalability improves through layer 2 solutions, Biitland’s infrastructure is designed to support higher throughout, low latency and proof of stake consensus, future proofing the network.

Tokenomics Expansion

Biitland is exploring stablecoins pegged to other currencies (EUR, GBP, JPY) and commodity backed assets (like gold). This opens up broader adoption across diverse economic zones.

Compliance and Regulation

By aligning with monetary policy and global regulatory frameworks, Biitland aims to bridge traditional finance and digital finance, ensuring long term financial sovereignty for its users.

Conclusion

Biitland.com stablecoins are not just another crypto product, they represent a meaningful step toward economic stability, financial inclusion and trustworthy digital money.

With solid infrastructure, transparent operations and a strong vision, Biitland’s approach to stablecoins is helping to reshape how we store, transfer and grow value in the crypto economy.

Whether you are a retail investor, DeFi enthusiast or institutional trader, stablecoins from Biitland offer a secure, accessible and innovative path forward in the digital age.

FAQs

What makes Biitland.com stablecoins different from USDT or DAI?

Biitland stablecoins use a hybrid model of collateral backed and algorithmic stabilization, combining the best of both USDT (reserve backed) and DAI (smart contract driven) for optimal price stability.

Are Biitland stablecoins safe to use?

Yes. They are secured by audited smart contracts, built on trusted blockchain networks,and fully compliant with KYC/AML policies.

Can I earn interest with Biitland stablecoins?

Absolutely. You can participate in staking, yield farming or liquidity pools, generating passive income within the Biitland DeFi ecosystem.

Are there any transaction fees?

Minimal. Biitland leverages high performance blockchain infrastructure to ensure low fees and fast settlements, especially compared to traditional banking.

What wallets support Biitland stablecoins?

Most Ethereum compatible wallets (MetaMask, Trust Wallet) and custodial wallets integrated with the Biitland platform support its stablecoins.

Can I use stablecoins for real world purchases?

Yes. Many online vendors, freelancers and global platforms now accept stablecoins, and Biitland is actively working to expand its merchant integration network.