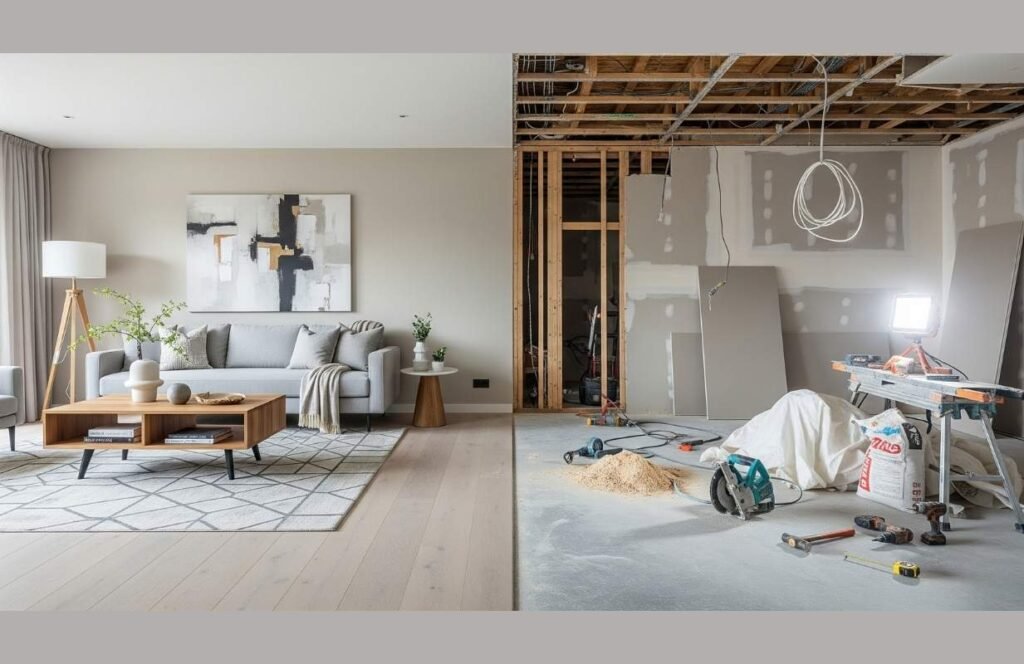

Contractors financing home improvements has become a popular way for homeowners to upgrade their houses without paying everything upfront. When you want to remodel your kitchen, replace a roof, or add a new deck, the cost can be high. Many contractors now offer financing solutions that let you pay in smaller monthly amounts instead of a big one-time payment. This makes home improvement projects more affordable and accessible.

What Is Contractors Financing Home Improvements?

Contractors financing home improvements simply means that your home improvement contractor gives you options to finance your project. Instead of needing to secure a loan separately, contractors work with financing companies or banks to offer payment plans. This way, homeowners can spread costs over months or years while the contractor gets paid upfront by the lender.

These financing options can be for projects like:

- Kitchen and bathroom remodeling

- Roofing and siding replacement

- HVAC installation or upgrades

- Windows and doors replacement

- Landscaping and outdoor living spaces

Benefits of Contractors Financing Home Improvements

Financing through your contractor has many benefits for both homeowners and contractors. Let’s look at why this option is becoming more common.

For Homeowners

- Immediate project start – No need to wait to save money. Projects can begin once financing is approved.

- Flexible repayment – Choose from plans with different terms that fit your budget.

- Quick approval process – Many financing programs give decisions within minutes.

- Lower upfront stress – You don’t need to pay the full project cost all at once.

For Contractors

- Faster payments – Contractors are paid upfront by financing companies.

- More closed deals – Customers are more likely to move forward with projects.

- Improved customer trust – Offering financing shows professionalism and care.

- Competitive advantage – Contractors stand out by giving flexible payment options.

Types of Contractor Financing Options

Contractors financing home improvements usually involves different kinds of plans. Each option is designed to meet the needs of homeowners.

Same-As-Cash Financing

This option lets homeowners delay payments for a set time, like 6 or 12 months. If the balance is paid within that period, no interest is charged.

Deferred Payment Plans

Homeowners can enjoy a delay in making their first payment. This might be 3, 6, or 12 months depending on the program.

Low-Interest Loans

Some financing programs offer fixed, low-interest loans. These loans can stretch over several years, making monthly payments affordable.

Long-Term Installment Plans

For bigger projects, contractors may offer installment plans of up to 10 or 15 years, similar to a home improvement loan.

Promotional Financing

Sometimes, contractors provide promotional offers like 0% APR for a limited time to encourage homeowners to start projects.

How Contractors Financing Home Improvements Works

Understanding how the process works makes it easier for homeowners to decide if it’s the right choice.

Step 1: Project Estimate

The contractor gives you a full estimate of the project cost.

Step 2: Financing Options

The contractor explains different financing plans available through their partner lenders.

Step 3: Application

You fill out a quick application, often online or on a tablet. Approval is usually fast.

Step 4: Approval and Agreement

Once approved, you choose your plan, sign the agreement, and set repayment terms.

Step 5: Project Start

The contractor begins work, confident they will be paid by the lender.

Step 6: Monthly Payments

You make monthly payments directly to the financing company until the balance is cleared.

Why Choose Contractors Financing Home Improvements?

Many homeowners hesitate to start projects due to high upfront costs. Contractor financing removes that barrier. Instead of waiting years to save, families can enjoy upgrades now. Financing also allows for larger projects that may not have been possible otherwise.

For contractors, offering financing can mean more business. Customers are less likely to walk away when they see affordable payment options.

Key Considerations Before Choosing Financing

While contractors financing home improvements is convenient, it’s important to consider a few things.

Interest Rates

Understand the interest rate before signing. Some plans may offer zero interest if paid within a time frame, while others charge ongoing interest.

Loan Terms

Check how long you’ll be repaying. Longer terms mean smaller payments but more total cost over time.

Monthly Budget

Make sure your monthly payment fits comfortably into your budget without strain.

Contractor Reputation

Work only with licensed, trusted contractors who partner with credible financing companies.

Transparency

Ensure all costs, fees, and repayment schedules are clearly explained before agreeing.

Step-By-Step Guide to Using Contractor Financing

Here’s a simple guide to help homeowners navigate contractor financing for home improvements.

Step 1: Plan Your Project

Decide what improvements you need. Whether it’s a new roof, remodel, or energy-efficient upgrades, have a clear goal.

Step 2: Get Multiple Quotes

Don’t settle for the first contractor you find. Get at least three quotes and compare not just price, but also financing options.

Step 3: Review Financing Offers

Ask each contractor about their financing partners. Compare interest rates, payment terms, and flexibility.

Step 4: Apply for Financing

Fill out the application provided by the contractor. This process is usually quick and simple.

Step 5: Review Approval Terms

Check the repayment schedule, monthly cost, and any potential fees before agreeing.

Step 6: Sign and Start

Once approved, sign the documents and your project can begin right away.

Step 7: Repay Monthly

Stay consistent with payments to avoid late fees or penalties.

Conclusion

Contractors financing home improvements is a smart option for homeowners who want to improve their homes without a heavy financial burden upfront. By offering flexible and simple financing solutions, contractors help families enjoy upgrades faster.

At the same time, contractors benefit from steady business and quicker payments. With careful planning, clear terms, and trusted contractors, financing can make home improvement projects much easier to achieve.

FAQs

What does contractors financing home improvements mean?

It means contractors offer payment plans through lenders so homeowners can pay for projects over time instead of all at once.

Do all contractors provide financing options?

Not all do. Many larger or specialized contractors offer financing, but smaller independent contractors may not.

Is contractor financing better than a bank loan?

It depends. Contractor financing is easier and faster, but bank loans may offer different interest rates. Always compare before deciding.

How long does financing approval take?

Most contractor financing programs provide instant or same-day approval, so projects can begin quickly.

Can I finance any type of home improvement?

Yes, most projects like remodeling, roofing, HVAC, and windows can be financed. The scope depends on the contractor and lender.

What credit score do I need for contractor financing?

Requirements vary. Some lenders need good credit, while others offer programs for fair or lower credit scores.