If you’ve been wondering how can I finance home improvements, you’re not alone. Many homeowners dream of upgrading their kitchens, adding extra rooms, or making repairs. But turning those dreams into reality requires money — sometimes more than you have in savings. The good news is there are many ways to fund a renovation, from using personal savings to exploring home improvement loans.

This guide will explain the basics, show you why financing renovations can be worth it, and give you step-by-step advice to choose the best option for your needs. Whether you’re asking “Is it difficult to get a home improvement loan?” or “What’s the best way to pay for a home renovation?”, you’ll find the answers here.

Understanding Home Improvement Financing

Financing home improvements means finding a way to cover the cost of repairs, upgrades, or remodeling when you don’t want to (or can’t) pay the full amount upfront. The money can come from your own savings, a bank, a credit card, or even government-backed programs.

Some homeowners ask, “How to borrow money for a home renovation?” The answer depends on your financial situation, credit score, and the size of your project. For example, a small bathroom remodel might be paid with savings or a personal loan, while a large addition might require a home equity loan.

The key idea is simple: you get the funds now, complete the work, and then repay over time — often with interest.

Why Financing Home Improvements Can Be Worth It

Paying for renovations through financing can be a smart move when done carefully. It allows you to start projects now rather than waiting years to save enough. Here are some benefits:

- Increased home value: Quality improvements can raise the market value of your property.

- Better living conditions: Upgrades can make your home safer, more comfortable, and more energy-efficient.

- Flexible payment terms: Loans and other financing options can spread costs over months or years, making them more manageable.

- Opportunity to lock in rates: Some loans offer fixed interest rates, so your monthly payments stay the same.

Financing is not free money, though. It’s important to understand the costs, risks, and terms before committing.

Step-by-Step Guide to Financing Home Improvements

The process of financing home improvements can be broken down into clear steps. Following these will help you choose the right method and avoid expensive mistakes.

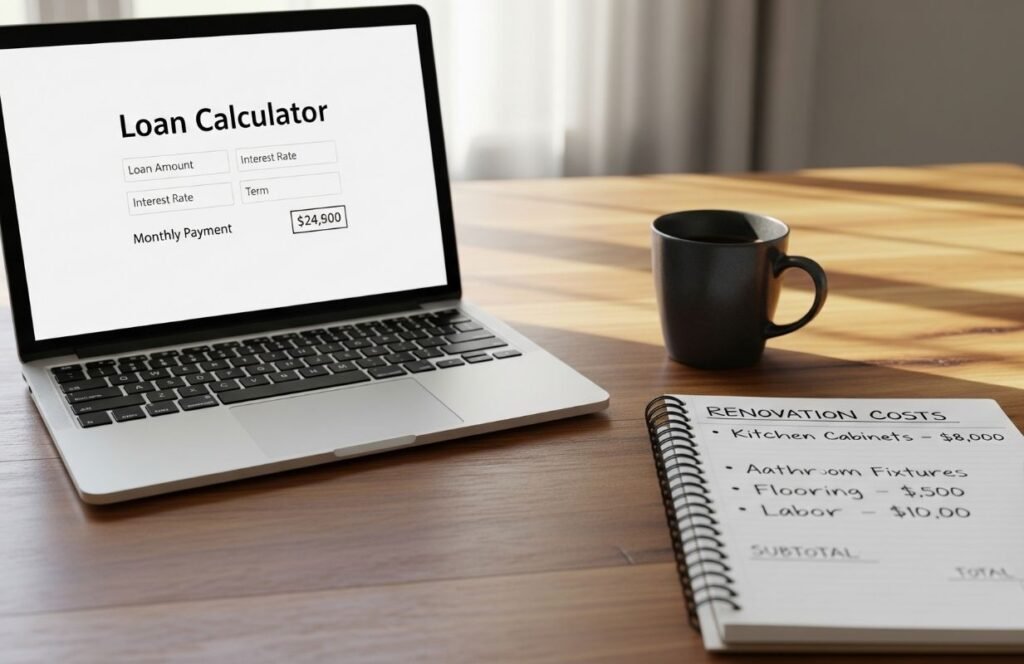

Step 1: Estimate Your Project Costs

Before you decide how to borrow money for a home renovation, you need to know how much it will cost. Research average costs for your type of project. Contact local contractors for quotes. Be sure to include extra for unexpected expenses — 10–20% is a safe cushion.

If your budget is small, you might be able to use savings or a credit card. For larger budgets, loans or home equity products might be better.

Step 2: Review Your Current Finances

Check your savings, income, debts, and credit score. Lenders use this information to decide if you qualify for a home improvement loan. If your credit score is low, work on improving it before applying.

Ask yourself:

- Can I afford monthly payments without cutting into essentials?

- Do I have other debts that might limit my borrowing ability?

Step 3: Choose the Right Financing Option

Here are some common ways to finance home improvements:

- Cash Savings: Paying with your own money means no interest and no debt. But it can deplete your emergency fund. Best for small to medium projects you’ve planned for.

- Personal Loans: A quick way to borrow without using your home as collateral. Approval depends on your credit score and income. Good for medium projects and those asking “Is it difficult to get a home improvement loan?” — personal loans are often easier to get than equity-based loans if you have good credit.

- Home Equity Loan: A fixed-sum loan using your home’s equity. Offers lower interest rates than most personal loans. Good for large projects but carries the risk of losing your home if you can’t pay.

- Home Equity Line of Credit (HELOC): Works like a credit card but uses your home’s equity. You borrow what you need, repay, and borrow again during the draw period. Rates may vary.

- Credit Cards: Best for small projects or bridging short-term costs. If you can pay off quickly, a 0% intro APR card can be useful. Otherwise, high interest makes it costly.

- Government-Backed Loans: FHA Title I loans or energy-focused PACE loans can be great for specific projects. They may have lower requirements for credit or income.

Step 4: Compare Lenders and Offers

Don’t take the first loan you’re offered. Compare:

- Interest rates

- Repayment terms

- Fees and closing costs

- Prepayment penalties

Online comparison tools can help you see which option fits your budget.

Step 5: Apply and Prepare Documentation

Lenders may require:

- Proof of income (pay stubs, tax returns)

- Proof of homeownership

- Details of your renovation project

- Credit history

Be honest and thorough. Missing documents can delay approval.

Step 6: Manage Your Loan Responsibly

Once approved, stick to your budget. Avoid adding extra upgrades unless you can afford them. Make payments on time to avoid penalties or damage to your credit score.

Tips for Success When Financing Home Improvements

- Don’t overborrow: Only take what you need, even if you qualify for more.

- Read the fine print: Understand every term, especially interest rate changes and fees.

- Plan for emergencies: Keep some savings aside for unexpected costs.

- Shop around: Rates and terms vary widely — even a small difference can save hundreds.

Conclusion

Answering the question “How can I finance home improvements?” starts with knowing your options and your budget. From using cash savings to getting a home equity loan or government-backed assistance, there’s a solution for nearly every homeowner.

The best choice depends on your credit, income, equity, and project size. By following the steps in this guide, you can make informed decisions and turn your renovation plans into reality — without risking your financial health.

FAQs

Is it difficult to get a home improvement loan?

It depends on your credit score, income, and equity. With good credit, personal loans and some equity-based products are relatively easy to get.

What’s the best way to pay for a home renovation?

The best way depends on your finances. If you have savings, use them for small projects. For larger ones, compare personal loans, HELOCs, and home equity loans.

How to borrow money for a home renovation?

You can apply for a personal loan, home equity loan, HELOC, or government loan. Each has different terms, so choose based on your budget and needs.

Can I finance renovations with bad credit?

Yes, but options may be limited. Some government programs and certain lenders work with lower credit scores, though rates may be higher.

Are home improvement loan interest rates fixed?

Some are fixed, like personal loans and home equity loans. Others, like HELOCs, usually have variable rates.

Can I use a credit card for home improvements?

Yes, especially for small projects. A 0% intro APR card can help if you repay before the promotional period ends.